Archive for the ‘Uncategorized’ Category

What Makes Business Work? The Little Things.

I hear all too often this really dumb joke: “Business Ethics? Isn’t that an oxymoron?” No, in fact, ‘business ethics’ isn’t a contradiction. Business just isn’t possible without some kind of ethics, some kind of reason to trust each other. Do unethical things happen, in business. Yes, sure. But those instances simply must be the exceptions that prove the rule. Of course, it’s easy to take for granted just how many little details of commercial & professional life require us to simply assume that other people are going to do what they say they’re going to do. Here’s an example.

I hear all too often this really dumb joke: “Business Ethics? Isn’t that an oxymoron?” No, in fact, ‘business ethics’ isn’t a contradiction. Business just isn’t possible without some kind of ethics, some kind of reason to trust each other. Do unethical things happen, in business. Yes, sure. But those instances simply must be the exceptions that prove the rule. Of course, it’s easy to take for granted just how many little details of commercial & professional life require us to simply assume that other people are going to do what they say they’re going to do. Here’s an example.

From the Vancouver Sun: Lawyer’s embarrassing antics are a drain on public purse

Vancouver lawyer Sheldon Goldberg has appeared in court while the wrong accused was in the dock as his client.

He recently precipitated a mistrial causing months of expensive court proceedings to be thrown out the window.

Yet for two days last week, a Law Society of B.C. disciplinary panel considered judicial complaints only about his apparent overbooking of court time and his refusal to properly reply to the provincial regulatory body’s inquiries.

Suspended for three months over incompetence last year, Goldberg has been a thorn in the side of the legal system for a long time. He was also suspended for a month in 2005.

Goldberg is in regular conflict with judges, and Provincial Court Judge William Kitchen triggered these latest proceedings.

In July 2007, Goldberg made arrangements for three conflicting court appearances in Surrey and Vancouver on the same day.

I don’t have any particular point of view on Mr. Goldberg’s behaviour, or of the Law Society’s apparent inaction. My aim here is just to point out how much a system like the legal system — or any business — takes for granted, in its everyday operations, that people are going to do simple, straightforward things like keep their word, show up when & where they say they will, etc. And to point out that when people simply stop doing so, things tend to fall apart pretty quickly.

—-

Thanks to JD & JB for pointing out this story.

Ethics of Supporting Your Local Economy

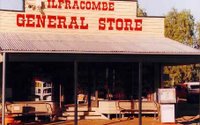

Hard economic times bring about a desperate search for solutions, both local and global. Some of the ideas that arise are good; others aren’t. Here’s a story about one such supposed solution, namely the idea of supporting local business.

Hard economic times bring about a desperate search for solutions, both local and global. Some of the ideas that arise are good; others aren’t. Here’s a story about one such supposed solution, namely the idea of supporting local business.

From the WSJ’s Independent Street blog: How the Locals are Trying to Save Small Businesses

Fed up with seeing local small businesses being ravaged by the economic downturn, some people are taking matters into their own hands. They’re trying to reverse the fortunes of mom-and-pop stores by becoming more organized in “buying local.”

– In Fort Myers, Fla., people driving by Clancey’s Restaurant saw this huge sign outside: “Support the local economy. Patronize locally owned businesses.” Local businesses there say that for every $100 spent at a chain or national business, only $14 stays in town, but when spent at locally owned businesses, the amount triples to $45.

….

In Chicago, two entrepreneurs established a Web site this month, SupportREconomy.com, to sell $2 green “R Local Stimulus” wristbands to benefit designated 10 small businesses and charities in the area. The grassroots effort aims to donate 20% of the profits to local pharmacies and grocery stores. Since the launch in mid-March, 250 wristbands have been sold, said Joana Fischer, the co-founder.

What the blog doesn’t explore is whether this is a good thing. Some will take that as obvious. But I don’t think it is.

First, such efforts seem to be rooted in the notion that economic benefit to own community are more important than economic benefit to other people’s communities. Now, stores and factories and jobs in your own community might well be more important to you than stores and factories and jobs in other people’s communities. That might make it individually prudent for you to support local business, but that doesn’t (by itself) make it ethical. Ethically, the jobs (for example) of employees of a factory in a neigbouring community are just as important as the jobs of employees of a factory in your home town. If you buy local, you’re helping someone locally, but you’re hurting someone, somewhere, too. That doesn’t make buying local bad — you’ve gotta spend your dollars somewhere, and can’t spend them everywhere. But you shouldn’t think buying local is automatically great.

Second, think about such efforts from a big-picture point of view. Picture not just your community coming together to buy local, but every community doing so. The result would be very little change in net purchasing, but there could be serious reductions in efficiency and hence a net decrease in total utility (i.e., in total wealth or total happiness). Example: People in Town A are good at making shirts, but bad at making pants. People in Town B are good at making pants, but bad at making shirts. Trade between the two towns allows everyone to get higher-quality goods, at lower prices. Buying locally means people in Town A get good shirts and lousy pants, and people in Town B get good pants and lousy shirts. In effect, efforts to promote buying locally raise barriers to trade, and barriers to trade usually hurt all concerned. And when you’ve got behaviour that is individually rational but collectively damaging, you’ve got the makings of a classic social dilemma.

(Note that the notion of supporting local business overlaps only incompletely with the recently-popular idea of eating locally. Eating locally can be — but isn’t always — a way to reduce carbon footprint. From an ethical point of view, the effect on efficiency of production needs to be considered, too. But that’s a blog entry for another day.)

Cloned Milk, Spoof Websites, and ‘Astroturfing’

Some of you may have noticed that I run another blog, the Biotech Ethics Blog. It’s mostly a place where I post news stories, with minimal commentary and minimal discussion. But one item I posted recently has clearly touched a nerve. It was an entry called CyClone Dairy: “Perfect Cows. Perfect Milk.” It’s about a website I found for something supposedly called Cyclone Dairy, a dairy that brags that all of its milk is from cloned cattle.

Some of you may have noticed that I run another blog, the Biotech Ethics Blog. It’s mostly a place where I post news stories, with minimal commentary and minimal discussion. But one item I posted recently has clearly touched a nerve. It was an entry called CyClone Dairy: “Perfect Cows. Perfect Milk.” It’s about a website I found for something supposedly called Cyclone Dairy, a dairy that brags that all of its milk is from cloned cattle.

Now, it’s true that the FDA has given approval, in principle, for the sale of milk from cloned cattle. But contrary to what this website implies, it’s not actually on the market yet. (I blogged about that here.)

Note also that the CyClone Dairy website includes no contact information — this apparently is supposed to be a company that wants to sell milk, but not to be contacted by buyers.

Note also that their Frequently Asked Questions page raises the question of ethics, but says simply “Are there any ethical issues about cloning? No.”

Add to that the fact that the domain name “cyclonedairy-dot-com” has been registered via a proxy, effectively rendering the true registrant anonymous — which a real company basically would not do.

So, the site is clearly a spoof, presumably by someone trying to stir up opposition to milk-from-clones or to biotechnology in general. Or maybe it’s some kind of art project. Who knows?

But the comments on the blog posting have also been interesting. There’s been some clear posturing & baiting, and one accusation of astroturfing (i.e., an effort at giving the fake impression of grass-roots concern.)

So, someone is messing with us. And I realize I’m playing into their hands by posting this, raising awareness of their site. I’m sure whoever’s behind it will unveil the secret, eventually…presumably after milking it for all it’s worth.

Leaving A.I.G.

The retention payments kept some A.I.G. employees around longer than they otherwise would have stayed. Ask yourself this: would you stay, and try to save the company, under the current conditions?

The retention payments kept some A.I.G. employees around longer than they otherwise would have stayed. Ask yourself this: would you stay, and try to save the company, under the current conditions?

The New York Times today published this letter, from Jake DeSantis, an executive vice president of the American International Group (A.I.G.)’s financial products unit: Dear A.I.G., I Quit!. The letter is addressed to CEO, Edward Liddy. Here are the first paragraphs:

DEAR Mr. Liddy,

It is with deep regret that I submit my notice of resignation from A.I.G. Financial Products. I hope you take the time to read this entire letter. Before describing the details of my decision, I want to offer some context:

I am proud of everything I have done for the commodity and equity divisions of A.I.G.-F.P. I was in no way involved in — or responsible for — the credit default swap transactions that have hamstrung A.I.G. Nor were more than a handful of the 400 current employees of A.I.G.-F.P. Most of those responsible have left the company and have conspicuously escaped the public outrage.

After 12 months of hard work dismantling the company — during which A.I.G. reassured us many times we would be rewarded in March 2009 — we in the financial products unit have been betrayed by A.I.G. and are being unfairly persecuted by elected officials. In response to this, I will now leave the company and donate my entire post-tax retention payment to those suffering from the global economic downturn. My intent is to keep none of the money myself.

I take this action after 11 years of dedicated, honorable service to A.I.G. I can no longer effectively perform my duties in this dysfunctional environment, nor am I being paid to do so. Like you, I was asked to work for an annual salary of $1, and I agreed out of a sense of duty to the company and to the public officials who have come to its aid. Having now been let down by both, I can no longer justify spending 10, 12, 14 hours a day away from my family for the benefit of those who have let me down….

I’m not sure I’ve got anything new to say on this. But do read the whole letter. It puts a human face on the notion of pulling the rug out from someone, after you’ve promised to compensate them for their work; and it provides some support for my suggestion that failure to honour the contracts would do serious damage to A.I.G.’s prospects.

Some of you will scoff at the letter, or at the idea that a wealthy man like DeSantis could in any sense be a ‘victim.’ Fine. My guess is that the shareholders of whatever company employes Mr. DeSantis next will be a happier lot than the shareholders of the company he’s leaving.

Ah Sugar Sugar!

Lots of people have weird ideas about food. And that includes weird ideas about sugar. Some people seem to think that white sugar isn’t as, I dunno, not as groovy, somehow, as other kinds of sugar because it’s more “refined” (though I’ll bet you a dozen honey-glazed donuts that 9 out of 10 people can’t tell you what “refined” really means in this context). And when people have weird ideas about food, the food marketers of the world are not exactly predisposed to offering clear, unbiased corrective information on the topic.

Lots of people have weird ideas about food. And that includes weird ideas about sugar. Some people seem to think that white sugar isn’t as, I dunno, not as groovy, somehow, as other kinds of sugar because it’s more “refined” (though I’ll bet you a dozen honey-glazed donuts that 9 out of 10 people can’t tell you what “refined” really means in this context). And when people have weird ideas about food, the food marketers of the world are not exactly predisposed to offering clear, unbiased corrective information on the topic.

From the NY Times: Sugar Is Back on Food Labels, This Time as a Selling Point

Sugar, the nutritional pariah that dentists and dietitians have long reviled, is enjoying a second act, dressed up as a natural, healthful ingredient.

From the tomato sauce on a Pizza Hut pie called “The Natural,” to the just-released soda Pepsi Natural, some of the biggest players in the American food business have started, in the last few months, replacing high-fructose corn syrup with old-fashioned sugar.

The trouble? It’s a sham.

Though research is still under way, many nutrition and obesity experts say sugar and high-fructose corn syrup are equally bad in excess. But, as is often the case with competing food claims, the battle is as much about marketing as it is about science.

“As much?” No, it’s arguably far more about marketing. As far as I can tell, the battle between sugar and HFCS has a lot in common with the battle between Coke and Pepsi, or between Marlboro and Camel. Choose your poison.

Taking — And Enforcing — Responsibility for Litter

Litter is a classic example of what economists refer to as a “negative externality.” A negative externality is basically a cost, resulting from a transaction, but imposed on people not party to the transaction. Voluntary transactions are efficient when all the costs and benefits are borne by those who are part of the transaction. When others are forced to pay costs, that means the buyer isn’t paying the full cost of the good, and so too much of that good is likely to be purchased, from a social point of view. Economists call that “inefficient.” The rest of us call it annoying, and unfair. What can, or should, businesses do to help?

Litter is a classic example of what economists refer to as a “negative externality.” A negative externality is basically a cost, resulting from a transaction, but imposed on people not party to the transaction. Voluntary transactions are efficient when all the costs and benefits are borne by those who are part of the transaction. When others are forced to pay costs, that means the buyer isn’t paying the full cost of the good, and so too much of that good is likely to be purchased, from a social point of view. Economists call that “inefficient.” The rest of us call it annoying, and unfair. What can, or should, businesses do to help?

From the BBC: Store owner takes on litterbugs

A village shopkeeper is marking sweet wrappers and drinks bottles with the names of children who buy them in a bid to discourage them from littering.

Yvonne Froud, 52, took action after becoming fed up with the rubbish collecting in Joys Green in the Forest of Dean, Gloucestershire.

She said the village, particularly the children, had taken the campaign on board.

“It’s made a great difference. The whole village is a lot cleaner.”

It’s a neat idea (no pun intended). Of course, it only works because Froud’s shop is in a small town, and she literally knows all of her customers by name. So there’s no way for kids to give a fake name & avoid accountability.

Two thoughts occur:

1) Is some version of this possible, or desirable, in larger towns where the shopkeepers don’t know their customers by name? Presumably it’s not impossible, from a technological point of view: swipe an ID card at the till, the register prints out small ID stickers that the cashier slaps onto each item, etc. Worth it? Probably not, though maybe there’s a simpler way that I’m not thinking of.

2) As far as the BBC story mentions, the policy only applies to kids. My guess is that it only applies to kids because adults wouldn’t accept Froud’s well-intentioned meddling — even if they ought, ethically, to welcome it.

Madoff’s Accountant Charged

Left hand, meet right hand. Right hand, meet left hand.

Left hand, meet right hand. Right hand, meet left hand.

From Business Week: Prosecutors charge Madoff’s accountant with fraud

Bernard Madoff’s longtime accountant was arrested on fraud charges Wednesday, accused of aiding the man who has admitted cheating thousands of investors out of billions of dollars in the past two decades.

The charges against David Friehling, 49, come as federal authorities turn their attention to those who they believe helped Madoff fool 4,800 investors into thinking that their longtime investments were growing comfortably each year. Friehling is the first person to be arrested since the Madoff scandal broke three months ago….

How did it happen? Apparently, Friehling was on the one hand “pretending” to do at least some minimal sort of audit. But apparently not telling the people who could have checked his work:

The SEC accused Friehling of lying to the American Institute of Certified Public Accountants for years, denying he conducted any audit work, because he was afraid that his work for Madoff would be subject to peer review.

In other words, the left hand (AICPA) wasn’t in communication with the right hand (investors). Essentially, Friehling was flying under the radar of professional peer-review; no one checks your work if no one knows you’re doing the work. I sense an opportunity for a regulatory connecting of dots, here.

—–

Addendum: The fact that AICPA was in the dark came out back in December. See CNN Money: Madoff’s auditor… doesn’t audit?.

Change My Mind on AIG Retention Payments

If I’m wrong, help me understand why. Seriously.

If I’m wrong, help me understand why. Seriously.

Over the last 2 days, I’ve twice supported, on this blog, a very unpopular view. I’ve argued that, ethically, AIG is right to honour its legal obligation to pay $165 million in retention bonuses.

I’ve defended that view on two entirely separate grounds.

First, I argued that the payments should be made because they were promised, contractually, and it’s ethically important to honour contracts. We are duty-bound to uphold the law, even in defence of people we think are unethical or even criminal. (I even admitted, then, that the contracts might have been poorly-thought-out in the first place, but they’re still valid.)

Next, I argued that violating the contracts (by not making the payments) would be wrong because it could have disastrous effects. Namely, it would make it harder for AIG to attract and retain talent, and generally make it hard for AIG to make promises credibly.

So, I gave two very different reasons: one based on bad consequences, one based on rights and duties. Both arguments point in the same direction.

Lots of people offered counter arguments. “They’re all crooks.” “Why reward poor managers?” “Contracts are broken all the time.” “It’s symbolic.” Etc. I didn’t find any convincing.

But I pride myself on being reasonable; in fact, being open to reason(s) and counter-arguments is a professional requirement. So I have to ask myself: “What would it take to get me to change my mind on this?”

Two things come to mind. If you could show me either, it would weaken my support for the retention payments. If you could show me both, I guarantee I’d change my conclusion.

1) Show me that the individuals receiving the payments are culpable. (Culpability on its own doesn’t obviate one’s rights, but at least then you could make an argument that these payments are analogous to the “proceeds of crime.”) If only some of them are culpable, tell me why it’s fair to punish the innocent, along with the guilty.

2) Show me that failing to meet this contractual obligation would not hobble AIG, arguably the most important corporation in America. I’d like some evidence (not just conjecture) that a) there are qualified people (ones who won’t demand retention bonuses!) ready to step in at AIG and replace those who leave, and that b) AIG’s ability to make credible promises won’t seriously be shaken.

(p.s., this is a great exercise. I recommend it to everyone. Set out in writing what would change your mind. If the answer is “nothing,” then you’re operating on ideology or passion alone. And that’s your right; just don’t expect to convince anyone who doesn’t already share your view.)

What Should AIG’s Liddy Do?

What on earth should Edward Liddy do? Liddy was asked a year ago by the US government to take over as CEO of beleaguered insurance company, A.I.G. I’m not sure why anyone would want such a job. (Liddy is being paid $1/year, plus equity grants which give him a vested interest in seeing the company do well). Anyway, tough job.

What on earth should Edward Liddy do? Liddy was asked a year ago by the US government to take over as CEO of beleaguered insurance company, A.I.G. I’m not sure why anyone would want such a job. (Liddy is being paid $1/year, plus equity grants which give him a vested interest in seeing the company do well). Anyway, tough job.

Latest challenge on Liddy’s agenda: the recent dustup over $165 million in bonuses scheduled to be paid to executives. Bonuses? To executives? At A.I.G.? Why give bonuses to a bunch of people who so mismanaged their own company, and indeed contributed to destabilizing the entire U.S. economy? How on earth could that be ethical?

I blogged about this yesterday . I said I thought A.I.G. should honour the contracts, pay the bonuses. I argued that — distasteful as it might be — we ought to hold our noses and support Liddy’s intention to pay those bonuses. They are, after all, part of legally binding contracts. And though ethics and the law are not equivalent, honouring the law is ethically important. It’s just unethical to toss important rights out the window simply because we don’t approve of the people who benefit from them. I even offered a rather unflattering comparison: we supply state-appointed attorneys to (accused) child molesters (or even to ones who have confessed). Part of what it means to be a nation of laws is that the law protects even those we think unworthy. (Almost no one agreed with me, yesterday. I got accused of being an apologist, insensitive to the plight of those harmed by A.I.G.’s wrongdoing, etc.)

But yesterday I overlooked the significance of one fact: the bonuses in question are not performance bonuses. They’re retention bonuses, designed to keep people from fleeing the company for greener pastures. (Andrew Ross Sorkin, writing for the NY Times, explains this well: The Case for Paying Out Bonuses at A.I.G.) So, these bonuses are not backward-looking ‘rewards’…they’re forward-looking incentives.

OK, so, knowing all that, ask yourself this: what’s Liddy to do, if he really wants to rescue A.I.G.? To answer that, I think Liddy needs to know two things.

First, he needs to know whether the bonuses were a good idea in the first place. That is, are the people receiving these retention bonuses people worth retaining? Let’s assume, for the sake of argument (but I happen to think it’s a realistic assumption) that they’re mixed bag. Some of them are smart & honest, others are deadwood, and still others are untalented and/or dishonest.

Second, he needs to know whether, legally, he could in principle get away with breaking these contracts. Opinions seem to differ on that question. Glenn Greenwald, writing for Salon, says “yes.” A.I.G.’s external counsel says “no.” Let’s assume, for sake of argument, that he could.

So, we’re assuming a) that Liddy could weasel out of paying the bonuses, and b) that the employees in question are of mixed quality. So, Liddy has a genuine, non-obvious choice to make.

Here, as far as I can tell, are the 3 things that would follow a decision not to enforce the contracts:

1) A lot of people would cheer. They’d feel like they’d been granted just a little bit of vengeance, like they’d seen a little justice done.

2) Capable employees would flee A.I.G. (According to the NYT‘s Sorkin, ‘word on the street’ is that A.I.G. personnel are already being recruited by other firms.) That might include some of the execs who were owed bonuses; and it might include other A.I.G. employees who realize the company’s promises aren’t worth much. And do not assume they’d all be easy to replace. Would you take a job at A.I.G., if you were qualified? I wouldn’t, in part because…

3) A.I.G.’s credibility for signing contracts would be shot. No one in their right mind would accept employment, or supply goods or services.

Seriously. What should Liddy do?

A.I.G. Bonuses, Ethics, and the Rule of Law

It’s not unethical to pay people money you are contractually obligated to pay them. Even if doing so makes you, or other people, want to pull your hair out. It’s the right thing to do. Not always because the person getting the money deserves it, in some abstract sense, but because you promised.

It’s not unethical to pay people money you are contractually obligated to pay them. Even if doing so makes you, or other people, want to pull your hair out. It’s the right thing to do. Not always because the person getting the money deserves it, in some abstract sense, but because you promised.

From the NY Times: A.I.G. Paying $165 Million in Bonuses After Federal Bailout

The American International Group, which has received more than $170 billion in taxpayer bailout money from the Treasury and Federal Reserve, plans to pay about $165 million in bonuses by Sunday to executives in the same business unit that brought the company to the brink of collapse last year.

Word of the bonuses last week stirred such deep consternation inside the Obama administration that Treasury Secretary Timothy F. Geithner told the firm they were unacceptable and demanded they be renegotiated, a senior administration official said. But the bonuses will go forward because lawyers said the firm was contractually obligated to pay them….

You don’t have to like it, any more than you have to like providing state-appointed attorneys to child molesters (not that I’m comparing…well, you know.) Anyway, the point is: there are some things a civilized people governed by laws (rather than by the passions of the moment) have to uphold. The right of the accused to assistance in his defense is one; the right to speak (even if what you say is abhorrent) is a second; and the fulfillment of contracts is another.

The key source of outrage here is the fact that A.I.G. execs did such a miserable job, and yet are being rewarded with public money. Isn’t that worth violating even legally-binding contracts? Two points need to be made about that.

First, let’s not forget that although there is surely plenty of blame to go around within the walls of A.I.G., it’s highly unlikely that every single one of the people who is owed a bonus payment was derelict in their duties. I’m not sure it’s fair to want to punish everyone.

Second, if people are owed bonuses despite having done a lousy job, that means a mistake was made when the bonus system was set up. Putting appropriate incentive structures in place is, believe it or not, a challenging corporate governance problem. It looks like bad choices were made in setting that system up at A.I.G. And, unfortunately, those are bad choices that the U.S. taxpayer inherits (along with many others, no doubt) as the new de facto owners of A.I.G. It was a miscalculated (perhaps inept) promise, but the solution is not to renege on that promise now.

Leave a comment

Leave a comment