Archive for the ‘Uncategorized’ Category

Hiring the Donor’s Daughter

Nonprofit and charitable organizations face many of the same ethical challenges that other organizations face, but they may also bump into a few special problems from time to time.

As an example, consider the following HR dilemma, which was posed to me recently.

I work for a nonprofit organization in health research, and I’ve recently been told that I will be hiring and supervising a new individual whose parents are donating her salary for one year (it’s to be a one-year, limited-term position) in addition to making a sizeable donation. The hope is that, in time, the donors will make a significantly larger gift of a million dollars or more. The arrangement presents numerous challenges to me as a manager, since everyone in the upper levels of the organization agrees that the true nature of the arrangement can’t be revealed, but many employees will realize that the situation is unusual and will have serious questions about it.

I’ve presented my concerns to those involved, but the decision-makers are rationalizing their actions (they tell me it’s “for the good of the organization”), and asking me to embrace this “opportunity.”

Clearly, the mid-level manager here is in a tough position, caught between a rock and a hard place. The manager is being told, by those higher up, that this is the way things are. But the manager also has a team to manage, and the unorthodox hiring of this new “employee” may cause trouble.

Here are what I think are the relevant considerations:

1) I don’t think the basic arrangement itself is obviously unethical. The “employee,” here, is essentially a volunteer, being bankrolled by her father. A bit lame, for her, but if she provides the organization with some value, that in itself could be a good thing, in addition to the donation that her father is making and may later make.

2) Point #1 above assumes that this person will actually do some work, rather than just be padding her CV by means of this one-year position with a reputable nonprofit organization. If she’s just going to take up space, then her presence is inevitably going to be resented and hence disruptive.

3) Then there’s the question of whether this “hire” is affecting anyone else’s job. From what I understand, no one is being fired to make room for this new person. But even if no one’s job is immediately in jeopardy, it may have implications for who gets hired over the next year, who gets overtime, whose job is expanded in interesting ways, and so on. So other employees do have reason to be concerned.

4) The fact that senior management sees a need to hide what’s really going on, here, seems to be where the ethical problem lies. That part seems highly problematic. If this is a good “hire”, why not be transparent about it?

5) At a certain level, this is as much a “wise management” question as it is an ethics question. If (as seems to be the case) the current plan is bad for morale, then wise senior managers should realize that, and think this through more carefully.

All in all, I would suggest that the situation, as it is being handled by senior managers, represens a significant lapse in leadership. Their motives in accepting the deal — hiring this woman in return for a big donation — are reasonable enough. The mere fact that her hire wouldn’t go through the usual processes isn’t itself damning, provided that the net value to the organization is positive, and as long as no one’s rights are violated. Perhaps the ends here do justify the means — after all, we’re talking about the potential for a very large donation. But the fact that senior managers feel the need to keep the deal secret is a major red flag. Wise organizational leaders should work hard to make sure that, when compromises are being made, they are at very least compromises that they are able to defend, and about which they are willing to be transparent.

Rexall’s Dubious Homeopathic Offerings

The drugstore chain, Rexall, has been shaking things up a bit lately. Chain Drug Review recently posted a lengthy piece on how Rexall “aims to reinvent the drug store”. And a recent piece in the Ottawa Citizen says that the chain’s new products aim to make life better.

But not all of the attention lavished on Rexall has been so positive. Dr Terry Polevoy, an MD who runs the website Canadian Quackery Watch, recently showed me a highly problematic ad from a Rexall flyer inserted two weeks ago into his local newspaper, the Waterloo Record:

Trusted homeopathic remedies offer an alternative way to naturally treat symptoms. Speak to your local Rexall Pharmacist for more information or visit rexall.ca.

The problem, of course, is that homeopathy doesn’t work. Or, to be more precise, there’s no reliable evidence that it works, nor any plausible reason to think that it even could work. In commercial contexts, that’s pretty bad. And it’s worse still when the company selling the stuff is a company people rely on for competent health advice, and when that company leverages the credibility of a licensed health profession to promote bogus wares.

Rexall isn’t the only drugstore chain selling homeopathy and other ‘alternative’ healthcare products. A pharmacist friend who keeps his eyes open for such things tells me he’s seeing more and more of it. And last year, a class action lawsuit was filed against Shoppers Drug Mart and a company called Boiron, maker of a homeopathic preparation called “Oscillococcinum.” The suit alleges that Boiron breached several consumer protection statues in marketing Oscillicoccinum without evidence that it works.

But even if the suit against Shoppers fails, it’s worth remembering that what’s legal isn’t always ethical. It’s wrong to mislead consumers, even where doing so is legal. And the Rexall flyer is clearly misleading. Homeopathic remedies are incapable of treating symptoms — at least, unless the companies that make them have learned to violate the laws of physics and basic biochemistry. A homeopathic ointment may soothe skin because of the soothing properties of the non-medicinal cream on which it is based — if you take standard hand cream and add pixie dust it will now be “pixie dust cream,” but the fact that it makes your skin feel better won’t have anything to do with the power of pixies.

And then there’s the placebo effect, rooted in the well-documented fact that the power of suggestion can in some cases have real physical effects: if you believe a pill will cure your headache, then it just might. But such effects are quite hit-and-miss, and hard to predict, and in any case are predicated on a lie. Lying isn’t always illegal, or even always wrong, but when you lie in commercial contexts, both the law and society more generally takes a pretty dim view of it.

Now to be fair, I know that there are other products on drugstore shelves that raise questions about efficacy. Some studies have suggested that prescription antidepressants, for example, are no more effective than placebos. But the key is that there’s a rigorous (if imperfect) procedure for debating the effectiveness of prescription drugs. Yes, the makers of prescription drugs sometimes exaggerate the effectiveness of their products, playing fast-and-loose with the evidence. But the purveyors of ‘alternative’ therapies like homeopathy do that literally all the time.

When I asked him what he thought about this kind of marketing, Dr Polevoy said the following:

Rexall, like Shoppers Drug Mart, has one thing in mind when it comes to the marketing of homeopathic products. In my opinion, the bottom line — profits — is much more important to them than their customers, and whether or not these products work. Their customers are the ones who will ultimately pay the price, and the pharmacists have no power to warn their customers that homeopathy is bogus, and that they are wasting their money.

The commercial world is full of scams, and all too often people with something to sell have unwarranted faith in their products. Greed and ignorance are nothing new, but that that doesn’t mean they are excusable. Companies that claim not just to provide a product, but to educate and take care of consumers, ought to do better. They should do their best to sell only those products that they, and their customers, are justified in believing in.

Can SNC’s Reputation Recover?

Canadian engineering giant SNC-Lavalin continues to provide plenty of fodder for ethics classroom discussion, and making news in all the wrong ways. Over just the last three days, the company has made headlines for making over $1 million in illegal political donations in Quebec, for disguising dodgy payments to an agent in Angola, and for police searching the home of a former executive as part of a prosecution involving more than a dozen criminal charges.

Against this backdrop, slightly less attention has been paid to an announcement last week that the company had hired a former Siemens executive to take over the role of Chief Compliance Officer, a portfolio that ostensibly puts him in charge of ethics, too.

I was interviewed about this recently on BNN, (see video here) and the key question not surprisingly was whether having hired a new Compliance Officer is going to be enough to turn the company around, either in terms of ethics or in terms of reputation. In this regard, I think three key points need to be made.

First, a word about the relationship between ethics and compliance. The new guy SNC has hired (Andreas Pohlmann) is first and foremost in charge of compliance. Compliance with the law will of course be a very good start for SNC, but it’s just a start. Ethics has to be part of the picture. For that matter, even if Pohlmann’s only goal is to get the company consistently onto the right side of the law, there’s good reason he should pay attention to ethics, so that employees at SCN understand the ethical underpinnings of the laws the company has been breaking.

Second, the company needs to see that its reputation has to be built on more than its ability to pull off big engineering projects. SNC needs to be a company all stakeholders – including investors – can trust, because trust is the foundation of business. Given its track record so far, if I were looking for a big engineering contractor I wouldn’t put much trust in SNC at all. If they play fast-and-loose with the rules as much as they seem to, what’s to say they aren’t going to play fast-and-loose with their obligations to me, too?

Finally, the company needs to get past its apparent belief that bribery is just part of doing business. Bribery isn’t just illegal — illegal pretty much everywhere, even in places where it’s tragically common — it’s also bad business. And by “bad business,” I mean it is bad capitalism. It’s the opposite of free and open competition.

If SNC is going to regain its place as a rockstar Canadian company, it needs to show that it can go out there and compete and win on quality, rather than on its ability to bend and break rules.

CEO Pay for Performance in Canada

CEO pay — in Canada, at least — is apparently more closely aligned with corporate performance than most people have suspected.

Last week I had the pleasure of hosting Matt Fullbrook, Manager of the Clarkson Centre for Business Ethics and Board Effectiveness, as part of my Business Ethics Speakers Series. Fullbrook’s presentation focused on an interesting study recently completed by the Clarkson Centre.

Much of the discussion focused on this provocative graph:

The graph plots change in CEO pay against total shareholder return (TRS). Each dot represents a company listed on the TSX 60. The red dot shows the average for all companies studied. The blue shaded areas indicate companies at which CEO pay and shareholder value have been headed in the same direction (up or down) over the 8 years under study (2004-2011). The other areas show misalignment. The vast majority of companies are in the blue regions. Only at one company did pay rise substantially without a commensurate rise in shareholder value, and several companies showed phenomenal growth in value with no change in CEO compensation.

After his presentation, Fullbrook summarized the study’s findings for me this way: “Our research shows that CEO pay and performance are largely in sync at Canada’s largest corporations, contrary to conventional wisdom. Despite the Financial Crisis, and a significant amount of CEO turnover, most issuers have successfully aligned executive compensation with shareholder returns, which is great news for investors.”

I’ll leave you with just a couple of comments on this.

First, it’s worth noting that the x-axis on the graph above shows change in CEO pay, rather than absolute level of CEO pay. So while we can see that not many Canadian companies provided their CEOs with big raises, that doesn’t mean that they weren’t overpaid to start with. They may or may not have been; that’s a different study. But the fact that pay and performance are heading in the same direction is still pretty significant, given that lots of criticism has been rooted in the perception that CEO pay was climbing while investors get shafted. This study shows that, in general, that’s not true in Canada.

Second, just what counts as “alignment” is itself a difficult question, and during his presentation Fullbrook was thoughtful in this regard. What we see in the red dot in the graph above is a kind of correlation. It suggests that the pattern in Canada is that a slight upward trend in CEO pay is accompanied by a bigger upward trend in shareholder value. But this leaves open questions such as whether TRS is the right measure of “performance” (even if we focus exclusively on the interests of shareholders).

And if we try looking at individual companies, at a particular moment in time, the question of alignment becomes even more difficult. The word “alignment” itself arguably suggests parallel trajectories. But where a CEO is overpaid, it makes sense for pay to go down even while (hopefully) value is going up. The attempt there is to make pay commensurate with value, not to push them in the same direction.

Executive compensation continues to be one of the hardest problems faced by corporate boards, as well as an absolutely key ethical obligation. Doing it well is difficult when we’re not even sure what doing it well looks like.

Obamacare and Business Values

Yesterday, the US Supreme court mostly upheld Obamacare, also known as the Patient Protection and Affordable Care Act. (See the full decision here [PDF].)

The Big Decision may have been made, but clearly lots remains to be sorted out. One of the questions that arises, from an ethical point of view, is the way that businesses, including especially insurance companies, should conduct themselves under the new plan.

Under Obamacare, Americans will be required to carry health insurance (or face a penalty) and, importantly, insurance companies will be required to sell policies to all comers, regardless of pre-existing health conditions. While the debate has focused primarily on the proper role of government, the Patient Protection and Affordable Care Act clearly has significant implications for private companies.

Note how different this is from, for example, Canada’s system. In Canada, insurance is provided by provincial health plans, and care is provided by physicians (as private contractors) and private, not-for-profit hospitals. Private insurers still play a role in pharmaceutical coverage, but almost no role at all in basic healthcare. Under Obamacare, in comparison, insurance companies effectively become an instrument of public policy: important elements of the way they conduct their business (and in particular the actuarial rules they apply) will no longer be up to them. This is far from the only example of private companies playing a role in public insurance: in the UK, private companies play a significant role in administering employment insurance services, and in some Canadian provinces private insurance brokers sell auto insurance plans underwritten by a public insurer. With regard to insurance, the distinction between private and public is far from water-tight.

How should companies conduct themselves when they play a role in delivering publicly-mandated insurance? Should they continue to think of themselves entirely as private, profit-seeking entities? Or should they — like industrial firms during times of war — take up public values?

Just what values are instantiated in a public insurance scheme is a matter of some debate. Public insurance schemes are often seen as promoting egalitarian values — ‘we’re all equal and hence all deserve equal access to basic healthcare.’ Others argue that what’s really at stake in such schemes is not equality, but efficiency (and argue that the current patchwork American system, for example, is quite inefficient in a number of ways). Others argue that, for insurance quite generally, solidarity is the key value — and one with obvious salience when insurance is part of the welfare state. Of course, to the extent that insurance companies are “merely” private corporations, they are guided by basic norms related to loyally seeking profits for shareholders. But even private insurance companies are subject to special limits on their profit-seeking. From a legal point of view, it is recognized that insurance companies are morally special: the legal principle of uberrima fides implies that the level of trust required between insurer and insured makes the relationship special, from an ethical point of view. And then, with regard to mutuals and not-for-profit insurers, stewardship of a shared resource (i.e., the insurance fund upon which members rely) is a key value. It seems right that private and public insurers would be guided by different mixes of these values.

So the question American health insurance companies face, at least in principle, is whether they should conduct themselves like private or public entities. And the question Americans face is which standard to hold them to. The answer, I think, is not clear. But it’s worth pointing out that the goals of an institution — public or private — don’t automatically have to be the goals of the larger system of which it is part. As I’ve pointed out elsewhere, the individual parts of a system don’t need to act according to the values of that system — sometimes they contribute by playing a more narrow role.

The coming years are sure to see significant changes in the US insurance industry. Whether the US government can succeed in getting private insurers to play a public-policy role remains to be seen, and depends in part on the willingness of those insurers to take up a public mission. But it depends just as much on whether the system Obama has designed is capable of harnessing the profit motive of insurance companies using it to get them to perform an important social function.

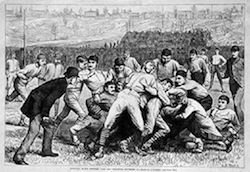

Football and Commerce: The Importance of the Rules of the Game

It’s often pointed out that business is a tough, hard-hitting game. In fact, that’s often cited as a reason for skepticism about any role for ethics in business. After all, ethics is (so they say) about good behaviour, not about aggressive competition. And there’s just no role for nicey-nicey rules in the rough-and-tumble world of business.

It’s often pointed out that business is a tough, hard-hitting game. In fact, that’s often cited as a reason for skepticism about any role for ethics in business. After all, ethics is (so they say) about good behaviour, not about aggressive competition. And there’s just no role for nicey-nicey rules in the rough-and-tumble world of business.

But, of course, nothing could be further from the truth. Rules are endemic to commerce, as they are to all other competitive games played by people in civilized societies. The rules of the game, after all, and the fact that most people play by them most of the time, are what differentiate commerce from crime.

This point is nicely illustrated by the serious scandal in which Football’s New Orleans Saints are currently embroiled.

The facts of this scandal are roughly as follows: players on the team, along with one assistant coach, maintained a ‘bounty pool’ amounting to tens of thousands of dollars, from which bounties were paid to players who inflicted serious injuries on players from opposing teams. This violates the NFL’s “bounty rule,” which specifically forbids teams from paying players for specific achievements within the game, including things like hurting other players. Why would the League have such a rule? Don’t they understand that football is a tough, hard-hitting game?

A game like football in fact has a couple of different kinds of rules. One kind of rule is there merely to define what the game is. The rule in football that says you can only throw the ball forward once per down is such a rule. The rule could easily be different, but the rule is what it is, and it’s part of what constitutes the game of (American) football. Other rules — including those that put limits on violence, and those that prescribe the limits on the field of play — have a more crucial role, namely that of ensuring that the game continues to be worth playing. Football (and hockey and a few other sports) involve controlled aggression and controlled violence, of a kind that would be considered seriously problematic, even illegal, if it took place outside of a sporting event.

The reason we consider such ritualized violence acceptable is that it is conducted according to a set of rules to which all involved consent. Players recognize that they might get injured, but they presumably feel it worth the chance of being injured in return for some combination of fame, glory, and a sizeable income. In addition, there are significant social benefits, including especially the enjoyment of fans who are willing, in the aggregate, to spend millions of dollars to patronize such sports. So the deal is basically that we, as a society, allow aggressive, violent behaviour, as long as it is played by a set of rules that ensures that a) participation in the game is mutually-beneficial and b) no one on the sidelines gets hurt.

The New Orleans Saints’ bounty system violated that social contract. It undermined the very moral foundation of the game.

And that is precisely how we ought to think of the rules of business. Yes, it’s a tough, adversarial domain. Apple should try to crush Dell by offering better products and better customer service. Ford must try its best to outdo GM, not least because consumers benefit from that competitive zeal. Indeed, failure to compete must be regarded as a grave offence. But competition has limits. And the limits on competitive behaviour are not arbitrary; nor are they the same limits as we place on aggressive behaviour at home or in the street.

The limits on competitive behaviour in business, however poorly-defined, must be precisely those limits that keep the ‘game’ socially beneficial. And it’s far too easy to forget that reasonably-free capitalist markets are subject to that basic moral justification. When done properly, such markets offer remarkable freedom and unparalleled improvements in human well-being. Behaviour that threatens the tendency of markets to produce mutual benefit effectively pulls the rug out from under the entire enterprise. Such behaviour is an offence not just to those who are hurt directly, but to all who enjoy — or who ought to enjoy — the benefits that flow from such a beautiful game.

Consumer Savvy: Must Customers Understand Your Business Model?

I’ll put this on the table as a fundamental ethical principle for commerce:

If your business model relies upon customers not understanding your business model, your business model is not an ethical one.

We might justify this principle in at least a couple different ways. We could work from first principles, and say that making sure your customers aren’t deceived goes along with basic standards of respect for other human beings. A decent company wants its customers to benefit, and thinks it has genuine value to offer them. Or we could point out that information is essential to the functioning of markets, and that the moral underpinning of markets requires that market transactions at least approach the ideal of full information for all parties.

Ponzi schemes are the extreme example: they rely entirely on “customers” (i.e., victims) not knowing that they are part of a Ponzi scheme.

But there are plenty of other, less extreme examples. For instance, when pricing is central to your business model (e.g., positioning yourself as an airline offering low-cost flights) then deceiving people about the true cost of your product essentially means hoping they don’t understand your business model, which is essentially as follows: “Advertise low prices but charge high prices by adding hidden fees.”

Here are a few current headlines about companies that seem to violate this principle:

- Subprime loan websites ‘mislead customers’

- New rules require airline ads to include all costs

- Consumers Can’t Sue Credit Repair Companies

- BBB Warns Consumers About Puzzle Contests From Opportunities Unlimited Publications Of Kansas City

Note that this principle doesn’t stipulate that all (or even any) customers actually understand your business model. (There are lots of reputable companies I that I deal with every day without having any real clue what their business model is.) The principle only says that your business model can’t rely upon people not understanding. If you’re relying on people not to understand, that means you essentially have nothing of genuine value to offer them in the first place.

And for that reason, it strikes me that deception about one’s business model is even more egregious than other kinds of deception in business.

Responsibility for Consumer Error

Who is responsible for a consumer’s subconscious and erroneous conclusions about a particular product? What if a manufacturer honestly and accurately says “our product does X”, and consumers mistakenly believe, as a result, that the product also does Y?

Case in point: a study was recently reported, indicating that consumers are more likely to perceive chocolate as low in calories when they are told that it is fairly-traded. This is a great example of the “halo effect,” according to which humans have a tendency to attribute a variety of unrelated positive attributes to any person or thing that they perceive in a positive light to begin with.

Now, it’s clear that consumers are being led astray, here, though presumably that deception is not the intention of the sellers of fair-trade chocolate. But, on the other hand, whatever their intentions in the past, the sellers of fair-trade chocolate now know that consumers are susceptible to this error. Do they now have a responsibility to disabuse consumers of this particular misconception about chocolate?

Now hold on, you say. Companies that label and advertise their products accurately and honestly can’t be responsible for every crazy, false idea that enters a customer’s head. Surely companies can assume a degree of common sense; and surely anyone with a bit of common sense knows that there’s no link between fair-trade and calories.

(It’s worth noting that companies sometimes do see fit to warn consumers about matters that ought to be common sense: “Don’t use hairdryer in tub;” “Results are not typical;” “Keep knives away from children.” Etc.)

But here’s the problem. The halo effect is a species of cognitive bias, which is the term applied to any of a large number of pervasive, subconscious mental leanings that tend to lead human reasoning astray. When subject to cognitive biases, humans tend to make decisions that are not rational, not in line with their own values and preferences. The point here is that no one is actually saying to themselves, “Gee, this is fair-trade chocolate, and therefore it must be low in calories.” That would be insane. But cognitive biases don’t work by rational processes; indeed, they short-circuit rational thought. That’s the whole problem.

So, do such effects, when discovered, result in new obligations for companies? Maybe. Sometimes. At least, if the effects of a particular cognitive bias are significant. The example cited above is pretty trivial — presumably the effect in question is not sufficiently powerful to send droves of consumers onto chocolate-eating binges. But more serious cases are easy enough to imagine. And surely some bit of responsibility comes with knowledge: companies tend to have sophisticated knowledge about their products, and are more likely than consumers to know when a dangerous bias is in the offing.

But the real challenge — for both companies and consumers — is that these sorts of subconscious effects are legion. And as more and more of them come to light, we’re going to understand better and better just how little we understand our own minds. Bit by bit, whatever is left of the idea that market exchanges occur under conditions of full information is going to evaporate. What that will mean for business ethics is hard to say; but the time to start thinking about it is now.

Is Animal Cruelty Illegal but Ethical?

Canadian’s largest independent chicken-processing company, Maple Lodge foods, was recently slapped with no fewer than 60 criminal charges related to inhumane treatment of chickens in transport.

Canadian’s largest independent chicken-processing company, Maple Lodge foods, was recently slapped with no fewer than 60 criminal charges related to inhumane treatment of chickens in transport.

This is a nice example to use to continue our exploration of the relation between ethics and the law. (Two weeks ago we discussed why what’s legal isn’t always ethical; last week we explored why following the law can be hard and hence breaking the law sometimes ethically forgivable.)

The Maple Lodge case is still before the courts, but let’s make a leap and assume, for sake of argument, that the company’s treatment of its chickens does turn out to be criminal. (I should add that my non-expert sense of things is that these charges are far from making Maple Lodge unique — legal violations seem pretty common in the business of processing animals for food.)

So let’s accept for the sake of argument that ML’s behaviour is criminal. Is it unethical?

I’ll apologize if it strikes you as crazy to ask whether inhumane treatment of animals is unethical, but we can often learn something by asking questions the answers to which seem obvious. There is, on the surface, broad consensus that animals are ethically significant — that they ought not, for example, be abused or tortured — but that consensus papers over an enormous number of differences of opinion with regard to exactly how animals should (and should not) be treated and exactly why.

The ethical basis for the presumption against animal cruelty, as it turns out, is far from clear and far from being a matter of consensus. Is animal cruelty bad because all suffering is bad? Because animals are part of our moral community? Because God made them? Because cruelty to animals engenders cruelty to humans?

And there are indeed respectable philosophical points of view that hold that animals don’t have any (direct) ethical significance at all, though the philosophers who hold such views are often at pains to reconcile those views with common human sympathies. The point here is that it’s not clear that inhumane treatment of animals is unethical per se. It’s clear that all ‘normal’ people feel sympathy for animal suffering, but that’s not the same thing.

The point here is not to pull the rug out from under the idea that hurting animals is unethical. The point is to say that, with regard to particular behaviours, we need to make an argument rather than just attempting to subsume all such behaviours under the general heading of “unethical behaviour.”

There’s another way to get at the ethics of animal welfare, and that’s to point to the general ethical obligation to follow the law.

In a reasonably-well-governed democracy, we all have a basic obligation to obey the law. There are, of course, a few well-understood exceptions. Speeding to get an injured child to the hospital can be ethically justified. And civil disobedience can be ethically OK (or even ethically obligatory) if done right. But such exceptions are rare, and it remains true that most of us should — ethically — follow the law, most of the time. If you disagree with the law, you should try to get it changed; wanton failure to comply isn’t activism, it’s just lawlessness. In a large democracy, there are an enormous number of differences of opinion, and there are always going to be a few laws that you, in particular, don’t really agree with. But you still — generally — need to follow the law. And that goes for corporations, too.

And so there’s a sense in which Maple Lodge’s behaviour may have been unethical, even if we set aside the thorny issue of the moral status of animals, if the company failed in its ethical duty to treat animals as it is legally required to treat them. But of course, that just brings the philosophical question full-circle: laws themselves stand in need of moral justification. And as I argued above, the moral foundation for animal cruelty laws is far from clear. So, question for discussion: in order to justify passing a law, is it enough to have broad social consensus that a business practice is wrong, or do we need to have agreement on the underlying moral principles?

Transparency and Hospital Executive Perks

The Globe and Mail reported yesterday that Ontario hospitals are “scrambling” to eliminate executive perks, in the face of new rules stating that compensation practices must be made public. Ontario’s hospitals are funded by tax dollars, and clearly they don’t want to be seen spending those dollars on things the public is likely to find dubious.

A few quick thoughts:

1. To a certain extent, transparency is an alternative to good governance: we the public want access to the details if we worry that the people who are supposed to be taking care of those details aren’t doing a good job of it. Yet the Globe story makes no mention of governance. There are quotations from a couple of board members, but no discussion of what hospital boards do and whether they’ve been doing it well.

2. The comments under the Globe story provide reason (though not necessarily a conclusive reason) against transparency. In particular, many of the comments reveal lack of understanding of what it takes to run a hospital or other major institution, and a general cluelessness about executive perks. (Example: A perk like membership in an exclusive private club might look odd from the outside, but a moment’s reflection should reveal that an executive who is responsible for massive fundraising efforts genuinely needs to be part of the kind of clubs where he or she can network with the right sorts of people.) Of course, if the public has a genuine ‘right to know,’ then that cluelessness is lamentable but not decisive. The public ain’t always right, but it’s always the public.

3. The fact that this story is about taxpayer money makes no difference, ethically. Some people will be aghast at the perks being paid “out of taxpayers’ pockets.” That’s silly. If there’s a good business case for offering perks, there’s a good business case for offering them at a public institution. If there isn’t a good business case, then offering them would be just as much an affront to shareholders as it would be to taxpayers.

4. Beware the perverse effects of transparency. In the the world of corporate (private sector) executive compensation, it’s been suggested that transparency is part of the problem. The worry is that a CEO at one firm sees how much executives at other firms are making, and not surprisingly asks to receive the same or more. And boards, not wanting to publicly declare their own CEO to be “below average”, give in. So transparency fosters a ratcheting effect that is partly responsible for current insane levels of compensation. Will the same happen at hospitals?

5. Currently, it looks like transparency is driving hospitals to eliminate perks. But the more likely long-term effect is that, rather than accepting reduced overall compensation, executives will simply ask for the cash equivalent of the perks they no longer receive. I’m not an expert on compensation, but my intuition says that that would end up costing hospitals (and hence taxpayers) more. Compare: my own contract with the university I work for allows me some benefits that I don’t make use of (and that, hence, the university ends up not paying for). If I demanded the cash value of those benefits instead, it would cost my employer more. So again, we need to return to the question of governance. If institutions are well-governed, then we on the outside shouldn’t sweat the details. If they’re not being well governed, the key question should be why not?

Comments (13)

Comments (13)